Company Finance Lab Authorized Elements Of Company Finance And Insolvency

Whether or not serving public sector organisations, owner managed businesses, non-public people or listed corporations with overseas operations, our purpose is to help our purchasers achieve their ambitions. By way of our broad investor base and close dialogue with distinguished institutional shipping traders, Arctic Securities provides purchasers with distinctive inserting power, documented via our observe record of successful transactions. Concentrate on highly specialised matters reminiscent of private equity, corporate governance and mergers and acquisitions. The corporate finance follow additionally has represented issuers and investment banks in reference to quite a few private investments in public fairness (PIPEs) in addition to venture capital financings.

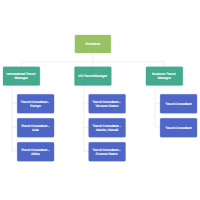

The link between these decisions and firm value will be made by recognizing that the value of a firm is the present worth of its expected money flows, discounted back at a rate that reflects both the riskiness of the projects of the firm and the financing mix used to finance them. The candidate can be responsible to handle groups, offering management strategy consulting services for shoppers.

Led by Wharton’s famend Finance faculty, this program will deliver finance executives up to date on a number of points resembling fintech and financial regulations, which are currently changing and …